The 7-Second Trick For Property By Helander Llc

Table of ContentsUnknown Facts About Property By Helander LlcGetting My Property By Helander Llc To WorkThe Only Guide for Property By Helander LlcUnknown Facts About Property By Helander LlcSome Known Incorrect Statements About Property By Helander Llc The 15-Second Trick For Property By Helander Llc

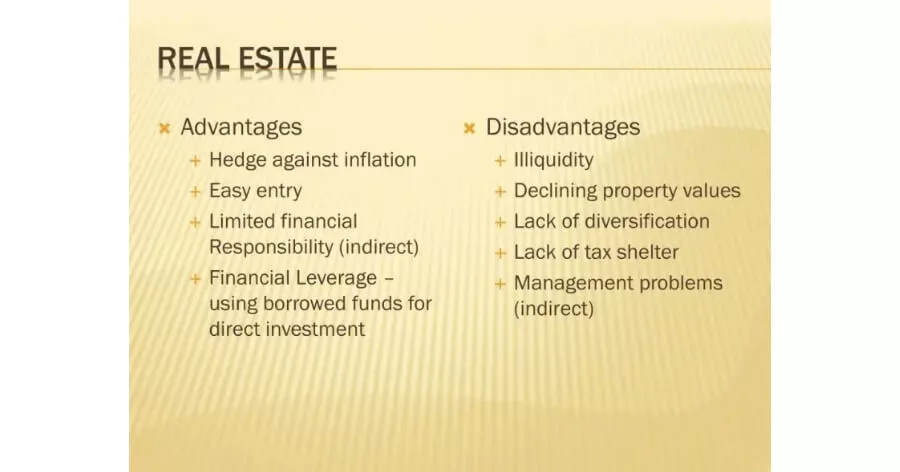

The advantages of buying actual estate are countless. With appropriate assets, financiers can appreciate predictable cash circulation, superb returns, tax advantages, and diversificationand it's possible to utilize genuine estate to develop wealth. Assuming concerning purchasing realty? Here's what you need to understand about realty benefits and why realty is considered a great investment.The benefits of spending in genuine estate include passive revenue, stable cash money circulation, tax benefits, diversification, and utilize. Real estate financial investment trusts (REITs) offer a way to spend in real estate without having to possess, operate, or finance properties.

Oftentimes, money circulation only reinforces with time as you pay down your mortgageand accumulate your equity. Investor can capitalize on many tax obligation breaks and deductions that can conserve cash at tax time. As a whole, you can deduct the practical costs of owning, operating, and handling a property.

Getting The Property By Helander Llc To Work

Realty worths have a tendency to boost in time, and with an excellent investment, you can profit when it's time to offer. Leas likewise have a tendency to rise with time, which can bring about higher cash circulation. This chart from the Reserve bank of St. Louis shows average home costs in the U.S

The areas shaded in grey show united state economic downturns. Typical List Prices of Houses Sold for the United States. As you pay down a home home loan, you develop equityan asset that belongs to your total assets. And as you build equity, you have the leverage to buy more buildings and boost cash circulation and wealth much more.

Since realty is a concrete property and one that can act as collateral, financing is easily available. Genuine estate returns differ, depending on elements such as location, possession class, and administration. Still, a number that several capitalists intend for is to beat the ordinary returns of the S&P 500what lots of people describe when they state, "the marketplace." The rising cost of living hedging capability of realty comes from the positive relationship in between GDP development and the demand genuine estate.

How Property By Helander Llc can Save You Time, Stress, and Money.

This, subsequently, equates into higher capital worths. As a result, realty tends to keep the purchasing power of funding by passing some of the inflationary stress on to lessees and by including a few of the inflationary pressure in the type of resources recognition. Mortgage loaning discrimination is illegal. If you believe you have actually been discriminated versus based upon race, religion, sex, marriage status, use public help, nationwide origin, impairment, or age, there are actions you can take.

Indirect property investing involves no direct possession of a building or properties. Rather, you purchase a swimming pool along with others, wherein a management firm possesses and operates buildings, otherwise has a portfolio of home mortgages. There are numerous manner ins which having realty can protect against inflation. First, residential or commercial property values may rise more than the price of rising cost of living, leading to capital gains.

Lastly, buildings financed with a fixed-rate loan will certainly see the family member quantity of the month-to-month mortgage repayments tip over time-- for circumstances $1,000 a month as a fixed repayment will end up being much less burdensome as rising cost try these out of living erodes the acquiring power of that $1,000. Usually, a main residence is ruled out to be an actual estate investment because it is made use of as one's home

The Property By Helander Llc Ideas

Despite having the help of a broker, it can take a few weeks of work simply to locate the ideal counterparty. Still, property is a distinctive asset course that's straightforward to understand and can boost the risk-and-return account of an investor's profile. By itself, property offers capital, tax obligation breaks, equity structure, competitive risk-adjusted returns, and a bush versus rising cost of living.

Purchasing realty can be an exceptionally rewarding and financially rewarding venture, however if you're like a lot of new investors, you may be wondering WHY you ought to be investing in real estate and what advantages it brings over other financial investment opportunities. In addition to all the impressive advantages that come along with investing in actual estate, there are some drawbacks you require to consider.

Property By Helander Llc Fundamentals Explained

If you're searching for a means to purchase into the realty market without having to invest hundreds of countless dollars, check out our properties. At BuyProperly, we use a fractional ownership design that enables investors to begin with as little as $2500. Another major advantage of property investing is the ability to make a high return from buying, remodeling, and re-selling (a.k.a.

All About Property By Helander Llc

If you are charging $2,000 rental fee per month and you sustained $1,500 in tax-deductible expenditures per month, you will just be paying tax obligation on that $500 revenue per month (Homes for sale in Sandpoint Idaho). That's a large distinction from paying taxes on $2,000 each month. The profit that you make on your rental device for the year is taken into consideration rental revenue and will be tired accordingly